FAQ: IRS 4506-C Form Update

Frequently asked questions regarding IRS transcript update

Effective starting October 1, 2022

The first step in this Modernization effort will be the inclusion of Optical Character Recognition (OCR) software. OCR programming will read the Form 4506-C as the form was intended. For the clean version of the form to be accepted by the Optical reader, it should:

- Be clear of any editing marks

- Only identify the transcripts, tax years, and/or taxpayers that need to be processed

- List the data on the assigned lines

The first step in this Modernization effort will be the inclusion of Optical Character Recognition (OCR) software. OCR programming will read the Form 4506-C as the form was intended. For the clean version of the form to be accepted by the Optical reader, it should:

- Be clear of any editing marks

- Only identify the transcripts, tax years, and/or taxpayers that need to be processed

- List the data on the assigned lines

Download FAQ | OCR IRS 4506-C FORM

Q1: What are the IRS products that are available by the form 4506C?

- 1040 products: Joint, Married filing separate, Head of Household, Single

- Wage & Income: W2, 1099

- Business returns: 1120, 1120S, 1065

Q2: Can multiple taxpayers be processed on one form?

Yes, with exceptions. If you are ordering IRS Wage and Income tax products (1099 & W2), then you need to ensure both taxpayers are on the form or complete individual forms for each taxpayer.

Note: The IRS will return transcripts for both taxpayers and will charge for both if not filed joint. See below.

Sample Requests | 4506-C Form

Acceptable - Order Detail Example 1. The input order details match the form:

Acceptable - Order Detail Example 2. The input order details match the form:

Not Acceptable - Order Detail Example 3. The input order details do not match the form:

Order Detail Example 4.

- ACCEPTABLE, if 1040 products only.

- NOT ACCEPTABLE for wage and income products. Note: Wage and Income products are for individuals only and 2 names on the form will return wage and income products for both individuals.

Q3: What would be considered an unacceptable request for the taxpayers on the form?

4506-C Form Example – Taxpayer 1 & Taxpayer 2:

Not Acceptable - Order Detail Example. The primary taxpayer is not input:

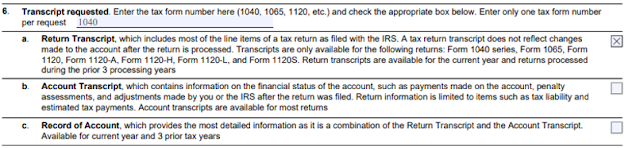

Q4: What is acceptable on line 6 of the 4506-C form?

The IRS allows one form type to be listed on line 6.

Acceptable - 4506-C Form Example

Not Acceptable - 4506-C Form Example

Q5: What boxes should be marked on the 4506-C form for a 1040 product?

If 1040 is on line 6 of the form then box A, or B or C should be checked on the form. Box A is for regular Transcripts, Box B is for Account Transcript, and Box C is for Record of Account.

Note: Marking multiple boxes could result in an NCS reject or multiple charges from the IRS. See below.

Here is the Order Detail to match the statement above and where you select the appropriate Box A, or B, or C. If you want, Account Transcript, or Record of Account use the dropdown and select the appropriate transcript type.

Acceptable - 4506-C Form Example

Not Acceptable - 4506 C Form Example

Q6: Can a 1040 product and a wage and income product be ordered on the same form?

Yes, with exceptions.

Note: The IRS will return ALL transcripts for taxpayers listed on line 1a and 2a. If you want all forms (wage and income) for each taxpayer, then each taxpayer needs to be input in the order details. If only one taxpayer is listed in the order detail this indicates your order is for that taxpayer only and only one name should appear on the 4506-C form.

Order Detail

Acceptable - 4506 C Form

Q7: How should the form be filled out for only a W2 or 1099 request?

List the form type you are requesting on line 6 and only mark box 7 on the 4506-C form.

Reminder: Wage and Income forms are for individual taxpayers only. If you have two taxpayers, then the forms returned will be for EACH taxpayer and the taxpayers must be input in the order detail. See below.

4506 C Form - Acceptable for W2 only request

4506 C Form - Acceptable 1099 only request:

Order Detail – 1099 only:

Q8: How do I request specific tax years?

Only the tax years needed for any product (1040s, W2s, 1099s) should be listed on line 8 for the 4506-C form and your order input years must match the form. See below.

Order Detail

Acceptable - 4506 C Form

Form 4506 C - Unacceptable

Q9: What forms will be returned if the taxpayers on the form did not file their 1040 products joint?

If the taxpayers do not file a joint tax return, then the IRS will return the forms filed by EACH taxpayer and IRS charges will apply.

Comments